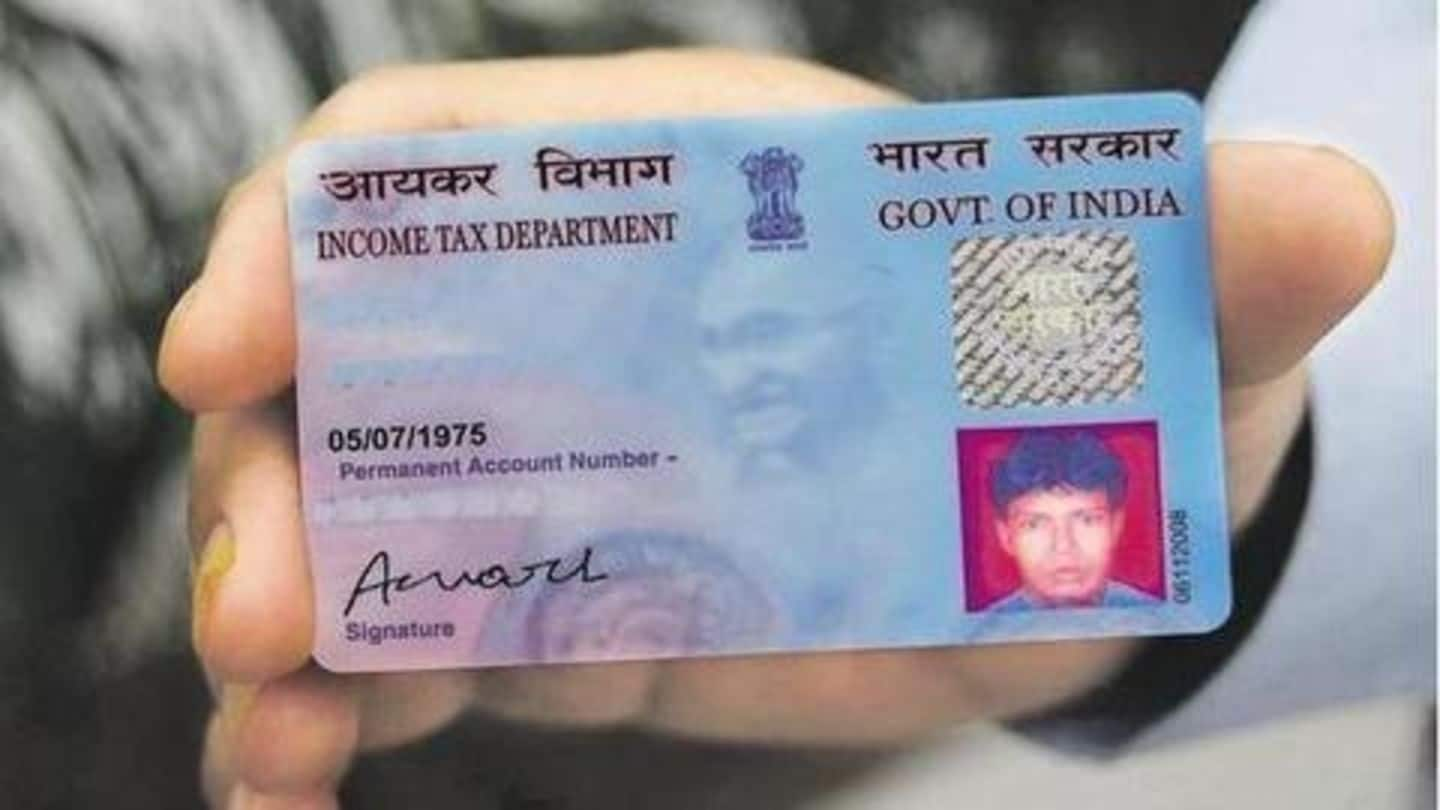

PAN card How to update your address using Aadhaar and why you need to do it Mint

A primary account number (PAN) is typically a 14- to 19-digit number that serves as a unique identifier on credit and debit cards as well as other cards that store value, such as gift cards..

Pan Card Data Entry Work, PAN Card Services Orixes Solutions, Noida ID 9299900230

Find PAN Card Details by PAN Card Number. Step 1: Log into the Official Income Tax e-Filing website. Step 2: Click on " Register " and Enter your PAN Card number. Step 3: Fill out the Registration Form and submit it. Step 4: You will receive a code via email. In order to confirm your account, click this link.

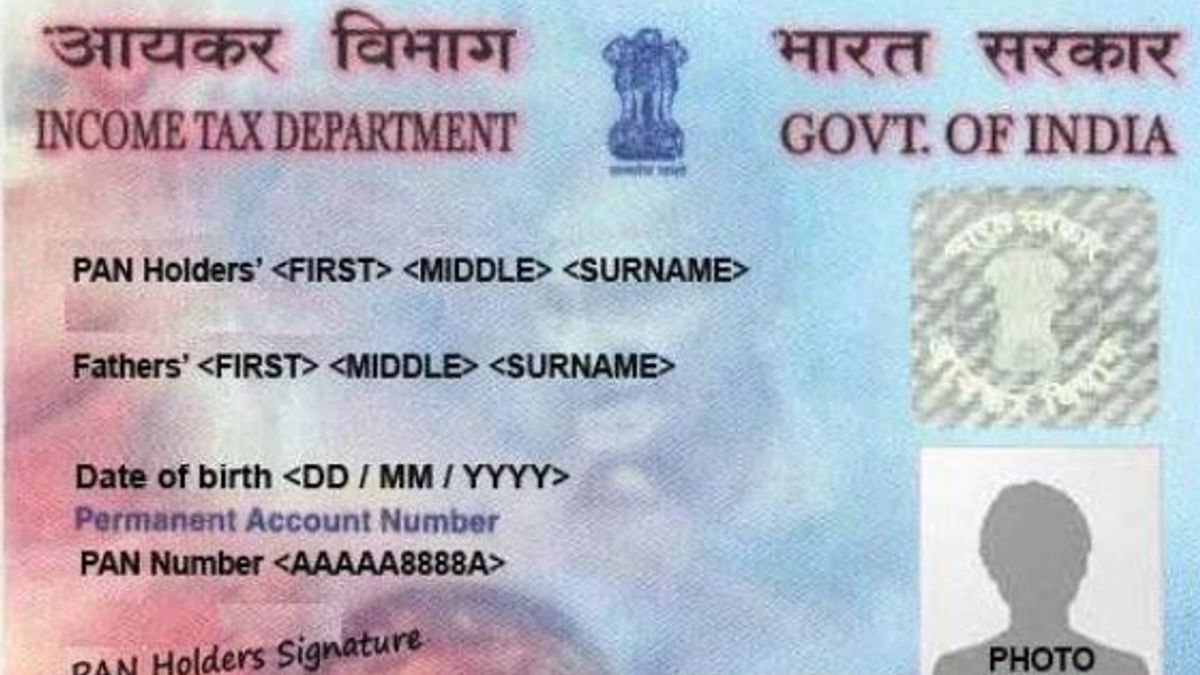

What is PAN Card, PAN Number, Uses and Benefits

Primary account number. A PAN is a 12- to 19-digit number that appears on a credit, debit, or prepaid card. It is an identifier issued by the card-issuing bank or financial institution. The PAN identifies the cardholder's account and also contains information about the card issuer and the card type.

PAN Number Permanent Account Number

Bank card number validation. The calculator checks a bank card number using Luhn algorithm, it also determines the card issuer according to Issuers handbook. Typical bank card number, also known as primary account number (PAN), consists of: 6 digits of issuer identification number - IIN also referred to as BIN (Bank identification number ) up.

PAN Card Basic knowledge about PAN Card Way2usefulinfo

This online method offers a quick and reliable way to check PAN card numbers. Third-Party PAN Verification Services Several third-party platforms also facilitate PAN card number checks. These services leverage the Income Tax Department's database to verify the authenticity of PAN details.

Indian Defaulter Permanent Account Number PAN Card

Step 7: My Account. Choose the "My Account" option from the profile settings drop-down menu. The details of the PAN will be displayed on the screen, which includes: The name of the taxpayer. PAN Number issued by the Income Tax Department. Date of Birth. Gender. Status.

5 fascinating details of your PAN card! Each letter, number possesses a significance Personal

Online application to obtain a PAN can be made through its website. NSDL e-Gov has been entrusted by Income Tax (I-T) department for acceptance and processing of PAN applications. Continue Reading Permanent Account Number or PAN card, issued under the Income Tax Act, contains a unique 10-digit alphanumeric code.

Pan Card Number Meaning/Know Each Character Of Your Pan/Pan Number Hidden Secret/10 Digit

Calculate the sum of the non-doubled numbers (i.e., odd numbers in the card number) Add the result of the third step to the result of step d; Divide by 10; If the result ends with 0, the card number is real. If the result is not 0, the card is not real, you may suspect it for a fraud case. By the way, with a 15-digit card number, you can do the.

Want to get a PAN card? Know how to get on in 10 easy steps Zee Business

Step 3: Next, select the "verify your PAN" link. Step 4: A fresh page will then appear in your browser window. Step 5: You will be needed to fill out your complete PAN information at this point. Step 6: Enter your PAN card number, name, birthdate, and mobile number here. Don't miss:Interesting Facts You Should Know About Indian Budget

PAN card verification How to verify your PAN online

Step-1 Go to home page of 'e-Filing' Portal https://www.incometax.gov.in/iec/foportal/ Step-2 Click on 'Verify Your PAN' from left hand panel Step-3 Enter the PAN, Full Name (As per PAN), Date of Birth and Mobile number and click on 'Continue'. Step-4 Enter OTP and click on 'Validate' button. Go to https://www.incometax.gov.in/iec/foportal/

Know all about PAN verification Times of India

PAN Card Number: As we all know, in today's time, PAN card is one of the most important documents. You can easily accomplish any major task through its use.. -After that you will easily come to know whether your PAN card is real or fake. Published at : 03 Jan 2022 03:49 PM (IST).

Know your PAN, Secret of PAN number, PAN NUMBER 10 digits explained, PAN digits meaning, PAN

What is the Indian PAN Number? A Permanent Account Number (PAN) is a ten-character alphanumeric identifier issued by the Indian Income Tax Department, to individuals and organizations to collect taxes. Interesting Read: "Data Privacy Vault" Other names Permanent Account Number PAN Card Indian PAN Protect your Sensitive Data with our "PII Vault"

Meaning of numbers on a pan card Pan card YouTube

A payment card number, primary account number ( PAN ), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number.

Pan Card 10 Digit Number Meaning YouTube

Know your Pan by Toll-Free Number. You can check Pan Card details by calling on a toll-free number.The service is free of cost and is available 24x7.. To know the details of your PAN, you call on the Income Tax toll-free number 18001801961 or on the Protean e-Gov Technologies Limited toll-free number 1800 222 990.. How to Know your Pan Status?

Get Acknowledgement Number Of PAN Card Check & Track Status

In short, the 14-, 15-, or 16-digit numbers on the front of your credit card, otherwise known as primary account numbers (PANs) are issued and used to identify individual cards by merchants at the point of sale (POS). If merchants get in the habit of storing unencrypted PAN on their networks, they can potentially put their entire network at big.

Pin by Aradhya Thapa on Aadhar card Aadhar card, Pan card real, Number cards

About DPAN. Whereas Primary Account Number (PAN) is the real card number, usually depicted on the card, the Device PAN (DPAN) is assigned to the card as a pseudonym. It looks like a PAN but it is not. It is associated with a particular device (e.g. a smartphone) which emulates the card virtually stored in the Google Pay or Apple Pay wallet.